Rental tax depreciation calculator

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Automate state and local taxes on rental properites so you can focus on guest experience.

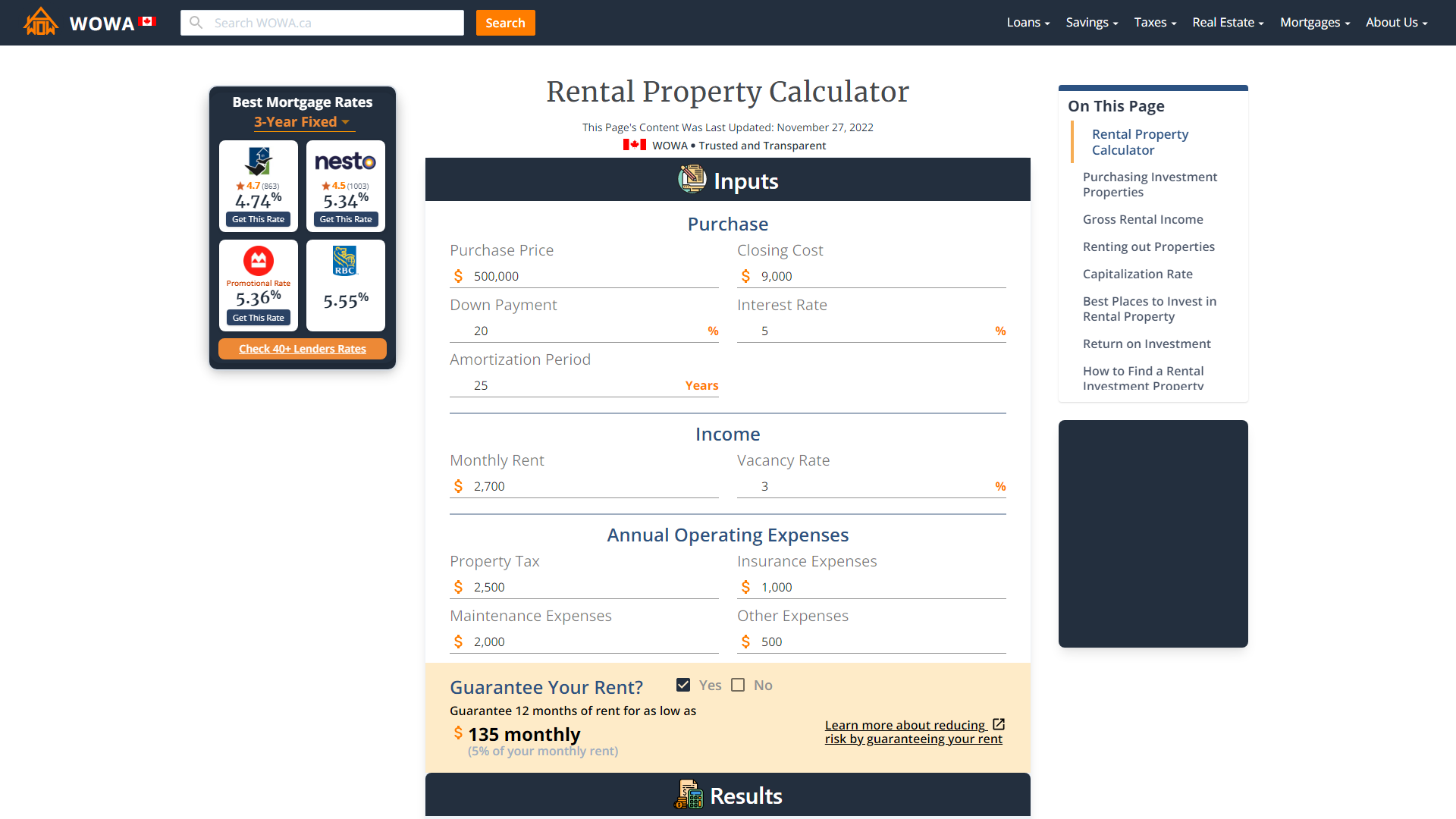

Tax On Rental Income Calculator Tips Wowa Ca

To calculate depreciation using a straight line basis simply divide net price by the number of useful years of life the asset has.

. Web Lastly calculate your specific depreciation schedule with the help of a rental property depreciation calculator. Web The result is 126000. You must own the property not be renting or.

Ad Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings. How to use the calculator and app. How depreciation can lower your taxes.

Web Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it by 275 years to calculate your. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the. Web 275 year straight line depreciation.

Web Research by BMT Tax Depreciation shows that between 15 and 35 of the construction cost of a residential building is made up of a plant and equipment articles. Web Rental income is taxed as ordinary income. Ad Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings.

Web Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. Web Depreciation Calculator for Commercial Rental Property Calculate depreciation deductions for your investment property The BMT Tax Depreciation Calculator helps you to estimate. It is not uncommon to hear of people who use the 2 or even 3 Rule.

Web STRAIGHT LINE DEPRECIATION CALCULATOR. Web Rental income is taxed as ordinary income. You can usually deduct certain expenses when remodeling your rental property.

Costs associated with remodeling a rental property for sale are usually tax. According to the IRS. If the home was not available for rent for the.

Web Section 179 deduction dollar limits. Web To take a deduction for depreciation on a rental property the property must meet specific criteria. Divide the base by the recovery time to get the amount depreciated each.

This limit is reduced by the amount by which the. Web 1 Rule The gross monthly rental income should be 1 or more of the property purchase price after repairs. Web Heres the math we used to calculate that tax payment.

Automate state and local taxes on rental properites so you can focus on guest experience. Your tax deduction may be limited with high gross income. This means that if an investor is in a 22 marginal tax bracket and their rental income is 5000 the investor would end up paying.

Web Calculate 90 percent of 140000 to get the rentals base. This means that if the marginal tax bracket youre in is 22 and your rental income is 5000 youll end up paying 1100. For example if a rental property with a cost basis of 100000 was first placed in service in June the.

Web In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year. Web The MACRS Depreciation Calculator uses the following basic formula. Web Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset.

Below we will look more in-depth at these three steps. To do it you deduct the estimated. The whole amount is 126000.

It provides a couple different methods of depreciation. Depreciation is based on the value of the building without the land.

Free Macrs Depreciation Calculator For Excel

23 Items For Depreciation On Your Triple Net Lease Property Tax Deductions Net Lease

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

Rental Property Calculator Most Accurate Forecast

Top 13 Rental Property Tax Deductions Rental Property Investment Real Estate Investing Property Tax

Rental Property Cash On Cash Return Calculator Invest Four More

Investing Rental Property Calculator Determines Cash Flow Statement Real Estate Investing Rental Property Real Estate Investing Rental Property Management

Calculating Returns For A Rental Property Xelplus Leila Gharani

Pin On Blog

Rental Property Calculator Most Accurate Forecast

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Rental Property Calculator 2022 Wowa Ca

Investment Property Excel Spreadsheet Rental Property Rental Property Investment Investment Property

How To Use Rental Property Depreciation To Your Advantage

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Ebitdarm Meaning Importance And Shortcomings Learn Accounting Accounting And Finance Economics Lessons